Who Are the First Time Homebuyers?

As a professional, you want to expand your clientele and work with a variety of people. Whether that may be vacationers, renters, old-timers or repeating buyers.

What about first-time home buyers?

These people are ready to get out of their small, crammed apartments and start a new journey in a spacious home.

Now you’re probably thinking, who now are those people in that position?

How old are they?

What do they do for a living?

What are their interests and hobbies?

Do they know how to buy a house?

No need to hire a detective, we’ve simplified the researching process for you.

According to studies done in 2016, there was a prominent group of people who made up the category of first-time home buyers.

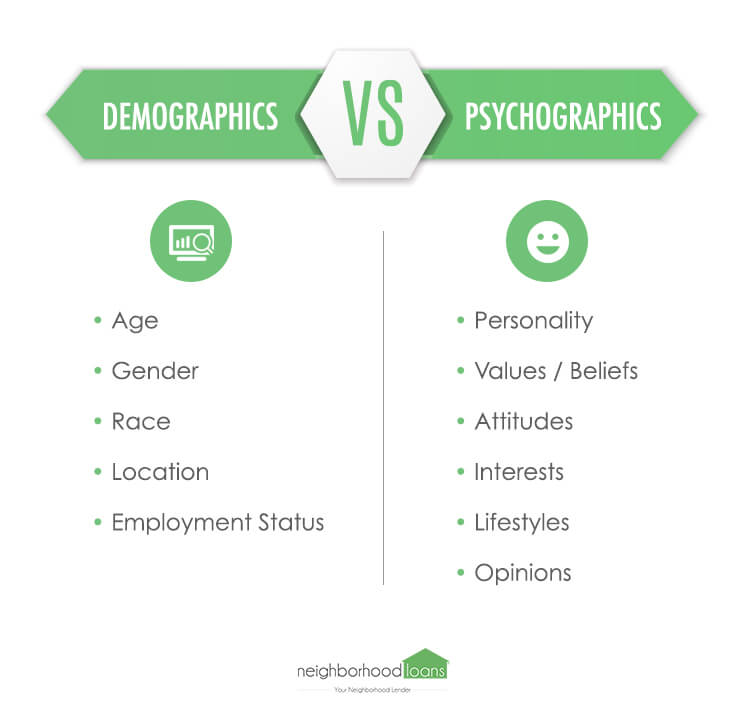

Demographics vs. Psychographics

Demographics (relate to the structural makeup of a population) are important to pay attention to for several reasons. For example, knowing who your audience is key to successfully transmitting a message.

When messages are sent out blindly, chances are the message won’t be interpreted by the right audience. These attributes then tie into an audience’s psychographics (relate to an individual’s opinions and interests).

Psychographics allow one to better understand an individual, based on their beliefs and emotions.

Both, demographics and psychographics help researchers and professionals market and cater to the right audience. Being knowledgeable of an audience’s genetic background and general interests drastically helps yourself as a marketer to create the right content to present to customers.

Understanding demographics and psychographics and how vital they are when marketing can help illustrate who your target audience is.

Below is a chart identifying the major differences between demographics and psychographics:

Who Are the First-Time Buyers?

According the National Association of Realtors’ survey, the Gen Y and the Millennials dominated the market with home purchases in 2016.

Over the past several years, it has statistically shown that 31 to 32-year-olds are the first-time home buyers. These group of people are now career and financially stable and can take on the responsibility of a mortgage.

First-time home buyers made up 35 percent of all home buyers in 2016. Opposed to 2015 with an all-time low of 32 percent.

The survey concluded buyer’s single or marital, gender and sexual status.

Knowing these demographics can help realtors simplify buyers home searching process by linking it with an area where they would be most satisfied.

Preferably, people want to surround themselves with their peers who share the same interests, values, lifestyle, and are in the same age range, according to Adam Gismodni, Ph.D.

A vast quantity of home buyers were married couples; however, the survey did not specify whether it was for just them two or with children.

Statistically, more single women bought homes than single men. The reason for this is unknown.

Majority of homebuyers reported to be heterosexual. A small percentage of buyers reported to be gay or lesbian. The other percentage of buyers preferred not to disclose.

The data collected from this survey also discovered a pattern of first-time home buyer’s home sizes, prices of homes and their income. The median size for first-time home buyers reported to be around 1,650 square feet, while the cost of homes was around $182,500. Reportedly, the median first-time home buyers’ income was $72,000.

[Tweet “”First-time home buyers made up 35 percent of all home buyers in 2016″”]

Making a Comeback

Rewind to 2015, it was known as the comeback year for first-time homebuyers.

As the economy was recovering from the housing market, homes started having more favorable conditions, such as looser lending standards, lower down payment mortgages and a bigger selection of homes.

In early December 2014, Fannie Mae and Freddie Mac implemented new lending guidelines and started offering 3% down payment mortgages. This was particularly appealing to first-time home buyers because they were more likely to qualify for a mortgage.

It was predicted that the sales of first-time home buyers were expected to rise more than 13% in 2015. With a sharp growth of first-time home buyers would create a domino effect by empowering existing home owners to sell and buy more expensive homes.

Because of the demand of homes was on the rise, the quantity of homes increased. The production of entry-level homes became more prominent and available for Millennials to choose from.

Not only had more houses become available, the prices had fallen. This made houses become more affordable for first-time home buyers which was another contributing factor to the comeback of 2015.

Statistically, Millennials make up the largest generation so far, meaning they have the largest impact on the housing market. In 2014, about 3% of Millennials (25 to 34-year-olds) could buy a home. With the large number of 25 to 34-year-olds out there today, a 5% purchase rate in 2014 had the potential to increase home sales more than 15% and took responsibility of 40% of all home sales.

[Tweet “”2015 was known as the comeback year for first-time home buyers””]

What’s the Buying Pattern?

In 2015, Gen Y and the Millennials again took first place with 32% for the number of homes purchased. As age increases, the search for a home decreases. Which explains why the runner up was Gen X, which made up 27% of all home purchases.

According to Nar Realtor data, the median income for first time home buyers was $76,900 in 2015. This number fell in 2016 to $72,000.

Throughout the years, married couples have consistently been the highest percentage for buying homes, whether it’s their first or second time. Regardless of age, married couples across the chart make up majority of home purchases.

Gen Y and the Millennials made up 68% of first-time home purchases in 2015. Leaving a huge gap between the next age group of 35 to 49-year-olds with 29%.

Takeaway

Since Gen Y and the Millennials are primarily responsible for sales in the house market, realtors, loan officers and mortgage lenders want their business. But, how do you reach them?

Gen Y and Millennials are extremely tech savvy and use the Internet for absolutely anything and everything. They typically start any research process online or on their phone.

To capture their attention, make sure you’re online. That way you have a better chance of being seen and used as a realtor in their mortgage process.

[emailcta]

Leave a Reply